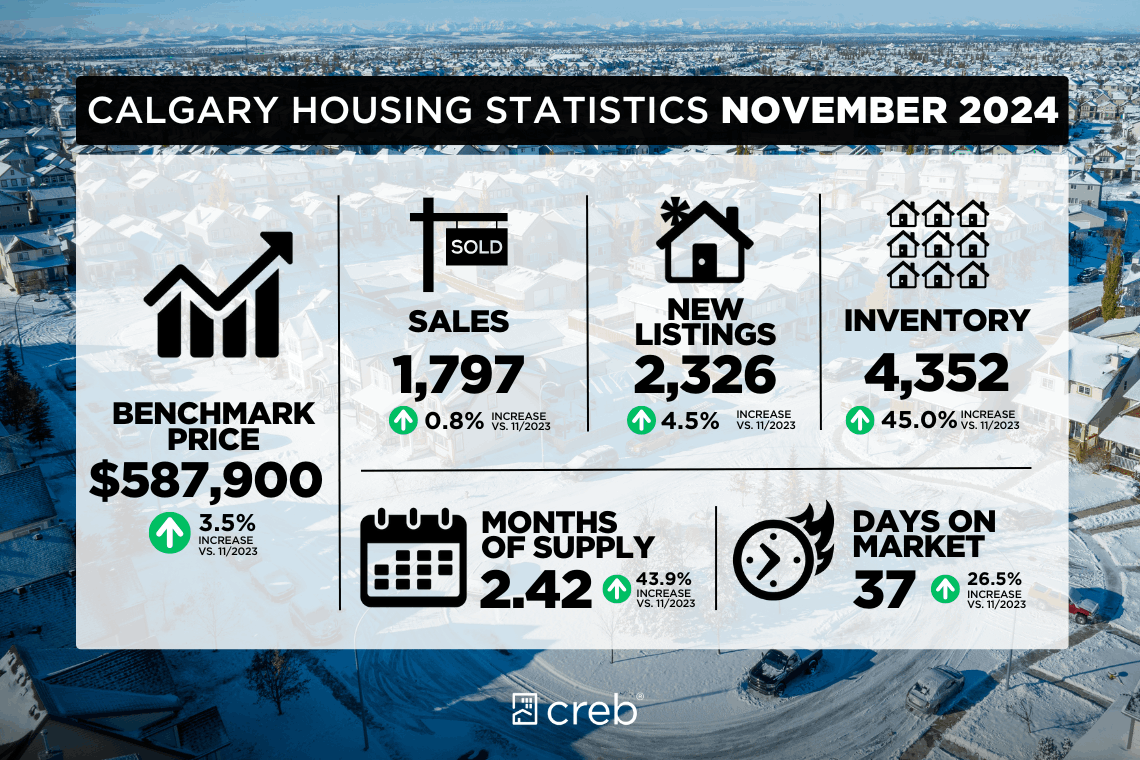

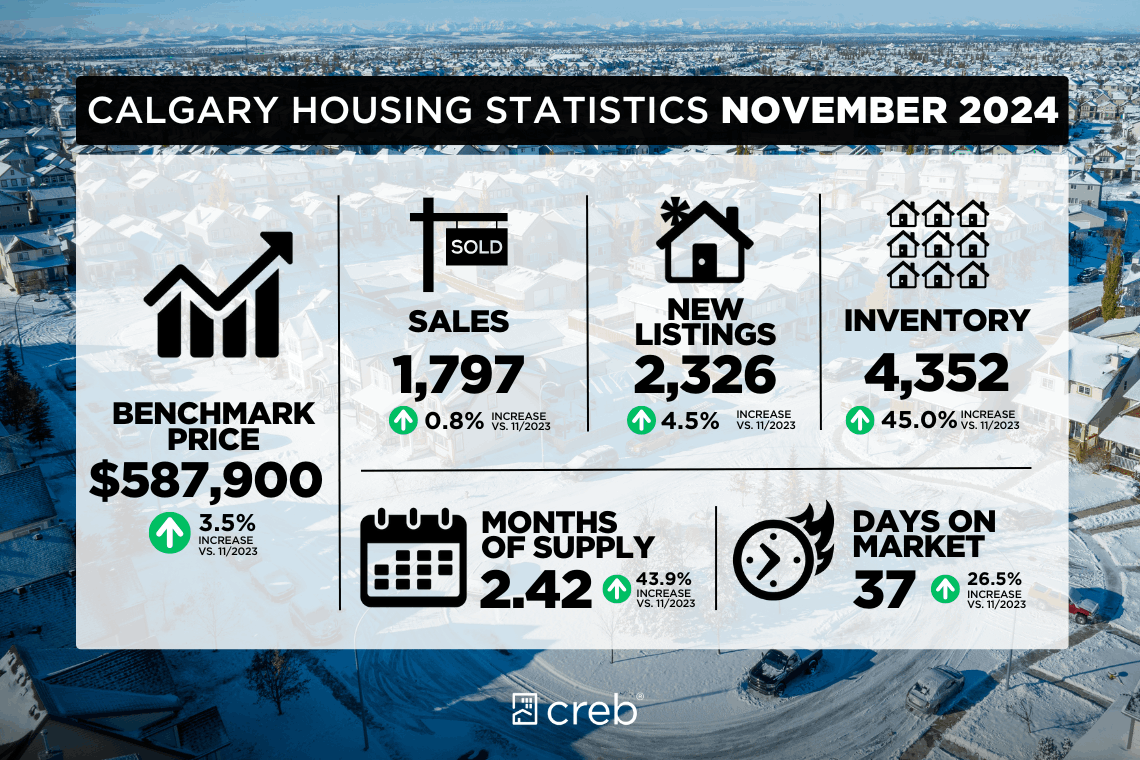

Supply on the rise, but not across all price ranges

As we transition into winter, Calgary's housing market is following typical seasonal trends, with activity slowing compared to the fall. However, year-over-year demand remains relatively strong. In November, increased sales in detached, semi-detached, and row homes offset a decline in apartment con

Home-Buying Advice You Shouldn’t Ignore

There’s no doubt about it: Buying a home might be one of the biggest purchases you make in your lifetime. It certainly could be one of the most life-changing. When it comes to something as meaningful as this, taking advice from a nosy colleague or well-meaning family member is not the way to go,

What to Know Before Making Your First Offer

When it comes to buying your first home, making an offer that meets all your criteria is a big deal. You are committing to a huge financial investment, and it needs to be taken seriously. While some things may differ from province to province or from city to suburbs, there are some factors that

Categories

Recent Posts