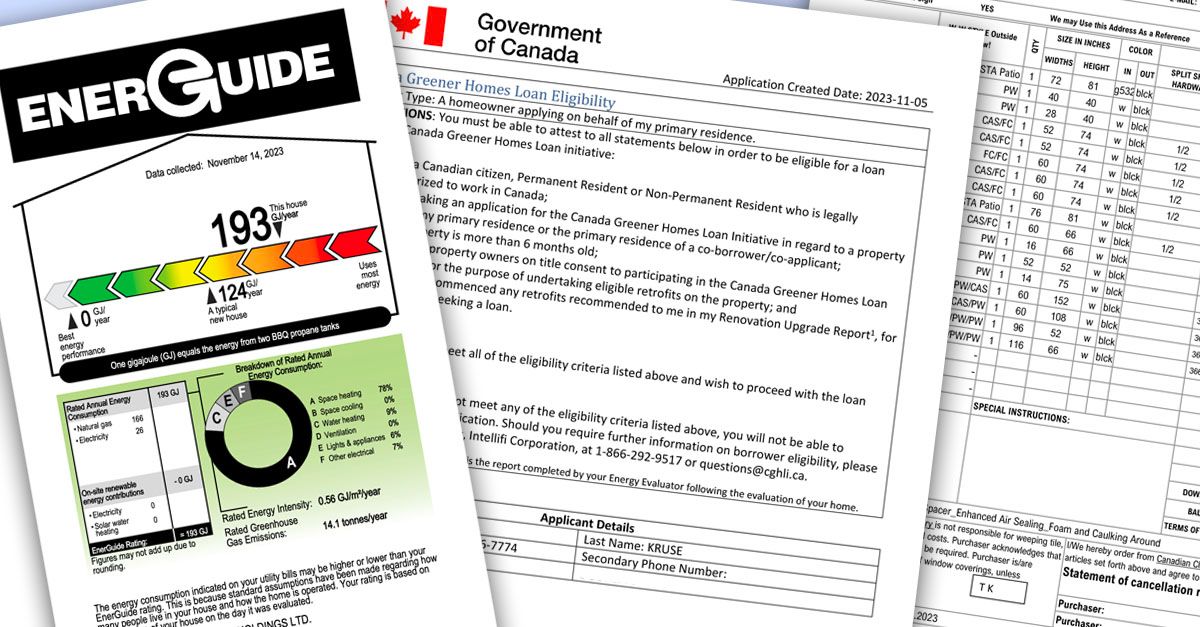

Canada Greener Homes Loan

The following is a direct copy from the Canada Greener Homes Loan

The Canada Greener Homes Loan offers interest-free financing to help Canadians make their homes more energy-efficient and comfortable.

The loan can help you finance eligible retrofits that are recommended by an energy advisor and that have not yet been started.

IMPORTANT: You should not start any retrofit work before your loan application has been submitted. Any retrofits started before submitting your loan application are ineligible.

Loan details

Maximum: $40,000

Minimum: $5,000

Repayment term: 10 years, interest-free

Loan type: Unsecured personal loan on approved credit

A maximum of one loan is available per eligible property and homeowner.

The maximum eligible loan amount is calculated based on the retrofits selected in the application and the quotes for this work. The eligible amount is capped based on industry standards and market norms. The maximum eligible loan amount may be less than your quoted cost, in which case you will be responsible for funding any difference.

Once approved, a portion of the loan can be delivered up front to assist in paying any deposits required by your contractor. The balance of the loan will be delivered after the retrofits have been completed and verified through a post-retrofit evaluation.

You cannot apply for a loan for the following:

- work that has already been started or completed

- retrofits that were not recommended in your pre-retrofit evaluation

- retrofits that are not included in your application (that is, you must not add additional retrofits to your loan application after it has been approved)

- retrofits that are not eligible for a Canada Greener Homes Grant

Eligibility

All loan applicants

There are some eligibility requirements to meet before applying for the loan:

- You must be a Canadian citizen, permanent resident, or non-permanent resident who is legally authorized to work in Canada

- You must own the home and it must be your primary residence

- You have a pre-retrofit evaluation and have not yet had a post-retrofit evaluation

- Your pre-retrofit evaluation was completed on or after April 1, 2020

- You have not started the retrofits for which you are seeking a loan

- You have a good credit history and are not in:

- a consumer proposal

- an orderly payment of debt program

- a bankruptcy or equivalent insolvency proceeding

Low-rise multi-unit residential buildings

Individual homeowners living in a low-rise multi-unit residential building (MURB) must meet the additional eligibility criteria for MURBs.

Indigenous group applicants

- You are eligible to register multiple homes

- You must own the home(s) or have a formal partnership to represent the owners, but the homes do not need to be the owner’s primary residence

- Your home must be occupied by an Indigenous household

- You must select at least one eligible retrofit for each property subject to the loan

Applying as an Indigenous government or organization?

Find dedicated support for your application by calling: 1-866-292-9517

Northern and off-grid communities

Canadians living in northern and off-grid communities face specific challenges when it comes to completing home retrofits, including higher equipment and labour costs. To help with this, all retrofit amounts have been adjusted to provide an additional 30% for northern and off-grid communities.

Additionally, homeowners living in northern and off-grid communities are eligible for replacements of existing fossil-fuel burning equipment. Further, homeowners living in a northern community are eligible for additional insulation measures (attic, ceiling, and exposed floor insulation).

More information for northern and off-grid communities

Loan application tips:

Ensuring your application is complete and accurate will improve processing time and allow you to start your retrofits sooner.

-

You cannot start any work until your loan application has been submitted. Any retrofits started before submitting your application are ineligible.

We recommend that you do not start any work before your loan application has been approved. If you choose to begin your retrofits before your loan application is approved, you are responsible for all costs if your application is declined.

-

Submitting an application with incomplete and/or inaccurate information will cause delays. Do not submit your loan application with missing documents or incomplete information.

-

Your loan application must include all retrofits that you plan to complete. Retrofits that are not included in your loan application cannot be added later.

If you include retrofits in your application that you later decide not to complete, these will be subtracted from your loan before final funding. The adjusted loan amount must be at least $5,000 to remain eligible.

-

Make sure that the quotes from contractors are clear and show the cost of the eligible energy efficient retrofits.

The maximum eligible loan amount is calculated based on the retrofits selected in the application and the quotes for this work. The eligible amount is capped based on industry standards and market norms. The maximum eligible loan amount may be less than your quoted cost, in which case, you will be responsible for funding the difference.

Upfront costs

Once approved, up to 15%* of the loan can be delivered up front if a deposit is required by your contractor. The initial advance is only available for retrofits that require a deposit. The balance of the loan will be delivered once the retrofits have been completed and verified through a post-retrofit evaluation.

You can request the initial advance during your application by uploading the quotes from contractors and entering the deposit amounts required to do the retrofit.

*The initial advance is increased to 25% if your property is located in the North or off-grid.

1. Find a service organization and schedule a pre-retrofit evaluation of your home

An energy advisor will evaluate your home and make recommendations on how to make it more energy-efficient and resistant to climate change. Only eligible retrofits that have been recommended by an energy advisor are eligible for the loan.

2. Plan your retrofits and obtain quotes from contractors

Review your pre-retrofit evaluation and decide which retrofits work best for you. Make sure to plan all your work in advance before applying for the loan.

Do not start any work until your loan application has been submitted. Retrofits started before submitting your loan application are not eligible.

Begin by speaking with contractors and obtain at least 1-3 quotes for each of the retrofits in your plan. Make sure that the quotes clearly show the itemized cost of eligible retrofits. All quotes must be clear and legible and must:

- provide a detailed summary of the costs of the work to be completed

- identify any deposits required by the contractor

- include the name and contact details for the contractors completing the work

Only costs directly related to retrofits recommended in your pre-retrofit evaluation are eligible for the loan. The maximum eligible loan amount may be less than your quoted costs in which case you will be responsible for paying any difference.

Important: Be aware of high-pressure sales tactics. Take your time to plan your retrofits, gather quotes and interview contractors.

Do-it-yourself (DIY) retrofits

Before you begin, know which retrofits require a licensed and trained professional. You are responsible for ensuring that retrofits completed are eligible for the program. Whenever possible, we recommend that you have a licensed and trained professional working on your home.

If you are completing any retrofits yourself, you must provide a detailed summary of all materials excluding labor. Personal labour costs are not eligible. All products must be purchased in Canada and online purchases are eligible only if they are ordered from an online distributor located in Canada. You will be required to provide all receipts later.

3. Submit your loan application before starting any work

To submit your loan application, you will require:

- Pre-retrofit evaluation file number

- Government issued photo identification (ID) with your address (for example, a driver’s license). If the photo ID does not show your address, you must also provide a utility bill that shows your current address

- Property tax bill or assessment

- Detailed quotes from contractors or a complete material and rental estimate from suppliers

- Proof of income and employment. Two of the following documents are required:

- Most recent pay stub(s) dated within 60 days

- Letter of employment dated within 60 days

- Bank statement(s) showing direct deposit for the most recent two-month period

- Most recent T4 or Notice of Assessment

Categories

Recent Posts