Uncertainty weighing on housing market

“It is not a surprise to see a pullback in sales given the uncertainty,” said Ann-Marie Lurie, Chief Economist at CREB®. “However, it is important to note that sales still remain stronger than anything reported throughout 2015 to 2020, where our economy faced significant economic challenges and job loss. Nonetheless, easing demand has been met with gains in new listings and rising inventories, helping our market shift back toward balanced conditions, following four consecutive years where the market favoured the seller.”

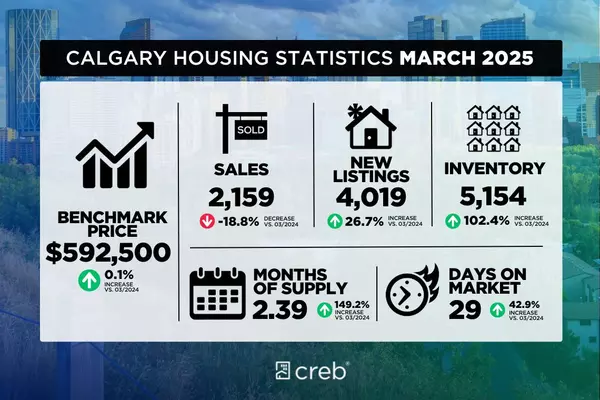

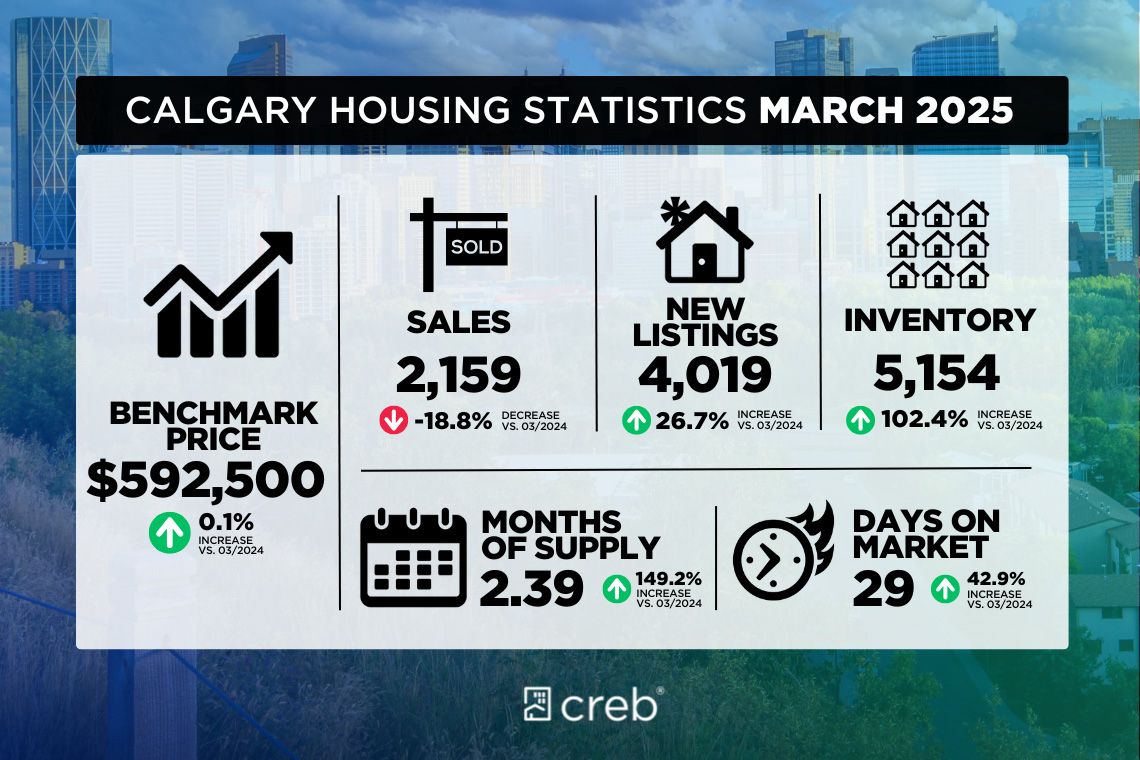

March reported over 4,000 new listings, causing the sales-to-new-listing ratio to drop to 54 per cent, low enough to support further inventory gains. Total residential inventory levels reached 5,154 units, and the months of supply pushed up to 2.4 months. While this is a significant change from last year, with limited supply options across all property types and price ranges, conditions reflect a better balance between a seller and a buyer today. However, the market significantly varies depending on location, price point, and property type.

Improving supply has taken the pressure off home prices following the steep gains reported over the previous four years. In March, the unadjusted residential benchmark price reached $592,500, relatively stable compared to both last month and prices reported last March. Both detached and semi-detached prices remain consistent with peak prices and continue to rise, while apartment and row-style homes continue to report prices slightly lower than last year's peak.

Detached

Detached sales totalled 1,035 units in March, a year-over-year decline of 10 per cent. The decline in sales was met with improving new listings, supporting inventory gains over last year's extremely low levels. The improving supply compared to sales has caused the months of supply to rise to just over two months, a significant improvement over the less than one month reported last spring. However, the months of supply continue to remain tight with less than two months of supply for homes priced below $700,000. We are seeing a shift toward more balanced conditions for homes priced above $800,000.

The unadjusted detached benchmark price reached $769,800 in March, a gain over last month and over four per cent higher than last year's levels. Limited supply options continue to support price gains for detached homes, although the pace of growth has slowed from the double-digit gains reported last year. Some of the largest gains occurred in the City Centre.

March sales slowed over last year's levels, contributing to the first quarter decline of 11 per cent. The decline in sales has also been met with a gain in new listings. While conditions still remained relatively tight over the first two months of the year, the boost in new listings in March relative to sales did support further gains in inventory levels, causing the months of supply to push up to 2.2 months, the highest monthly level reported since the end of 2022.

The shift to more balanced conditions is slowing the pace of price growth compared to last year. However, with an unadjusted benchmark price of $691,900 in March, prices are still over five per cent higher than last year and above the unadjusted peak reached in July last year. Year-over-year gains ranged across the city, with the largest gains occurring in the City Centre and West districts.

Row

March reported a surge in new listings with 697 units. The growth in new listings was met with 400 sales, causing the sales-to-new-listings ratio to ease, and inventories to rise from the lower levels reported last year. There were 826 units in inventory in March, pushing above long-term trends, but remaining shy of some of the highs reported prior to the pandemic. Supply levels improved across all price ranges, with much of the gains occurring in the North East, North and South East districts. Like other property types, improving inventory relative to sales has shifted the market toward more balanced conditions, especially for row homes priced above $500,000. This has also slowed the upward pressure on home prices. In March, the unadjusted benchmark price was $454,000, two per cent higher than last March, but nearly four per cent below peak levels reported in June of last year.Nonetheless, more supply has slowed the pace of price growth. The unadjusted benchmark price in March was $336,100, similar to last month and nearly three per cent higher than last March. Despite the year-over-year gain, prices remain below the peak reported last August. Prices are below peak across all districts, but the largest declines have occurred in the North and North East areas.

REGIONAL MARKET FACTS

Airdrie

With 160 sales in March, first quarter sales were 395 units, 11 per cent lower than levels reported at this time last year. Easing sales were also met with a gain in new listings, causing the sales-to-new-listings ratio to fall to 57 per cent in March and supporting further gains in inventory levels. Last year at this time, there was limited supply available in the market compared to the sales activity. While the 398 units in inventory are much higher than the 164 units reported last year, with nearly two and a half months of supply, conditions are still moving toward more balanced conditions. Shifting away from the sellers’ market conditions has taken some of the pressure off home prices. In March, the unadjusted detached benchmark price was $651,300, up over last month and over two per cent higher than prices reported last year. Recent gains have narrowed the gap from the peak price of $657,400 reported in June 2024.

CochraneSales in Cocrane remained consistent with last year's levels in March. After the first quarter, activity remained slightly higher than levels reported last year and well above long-term averages. New listings also improved, but thanks to the level of sales, the sales-to-new-listings ratio remained elevated at 67 per cent, slowing the growth in inventory levels compared to some areas. The 213 units available in inventory in March are a rise over last year's low levels, but are consistent with long-term trends for the month. Improvements in inventory and stable sales did cause the months of supply to trend toward more balanced conditions, especially compared with the previous four years. This shift has slowed the pace of price growth in the town. In March, detached benchmark prices reached $686,800, a gain over last month and over five per cent higher than last year. While price growth has slowed over last year, the current March price does reflect a new unadjusted record high for the town.

Okotoks

After the first three months, sales in Okotoks totaled 129 units, down from the 155 units reported in the first quarter of last year. New listings have started improving, but the sales-to-new-listings ratio remained above 60 per cent, and inventory levels remain exceptionally low. With 96 units in inventory and 53 sales in March, the months of supply remained below two months, driving further monthly and year-over-year price gains. While price growth has eased from last year, in March the unadjusted detached benchmark price reached $715,500, a new unadjusted record high and over five per cent higher than levels reported last year at this time.Categories

Recent Posts